Medigap or Medicare Advantage?

Key Points

Medicare Supplement plans offer key advantages, including the freedom to see any provider who accepts Medicare, no referral requirements, and the ability to choose your own Part D prescription drug plan. These plans also come with a one-time Medigap Open Enrollment window for guaranteed coverage.

In contrast, Medicare Advantage plans typically have provider networks, often include drug coverage, offer additional benefits like dental or vision, and have a maximum out-of-pocket limit for added financial protection.

While you can switch between these two types of plans, keep in mind that moving to a Medicare Supplement plan later may require you to answer health questions, depending on your specific circumstances and state rules.

We'll Find The Right Plan for YOU for FREE

We understand Medicare, so you don't have to

We’ve received many questions in our chat box about choosing between Medicare Advantage and Medigap—and it’s a topic I’ve helped people navigate countless times throughout my career. In this post, I’ll walk you through the key differences to help you make the best decision for your situation.

As you may know, Medicare, the federal health insurance program for U.S. seniors and individuals with certain disabilities, doesn’t cover all medical costs. That’s why many people choose to add supplemental coverage to help reduce their out-of-pocket expenses.

When comparing Medigap vs. Medicare Advantage, it’s important to understand that both are designed to help limit your out-of-pocket costs under Medicare. After all, no one wants to face a $1,632+ deductible for each hospital stay or be responsible for 20% of the cost of a costly procedure like an MRI.

The two main options to fill these coverage gaps are Medicare Advantage and Medicare Supplement (Medigap). Understanding how each works is the first step toward choosing the plan that best fits your healthcare needs and budget.

Deciding Between Medicare Advantage and Medigap (Medicare Supplement)

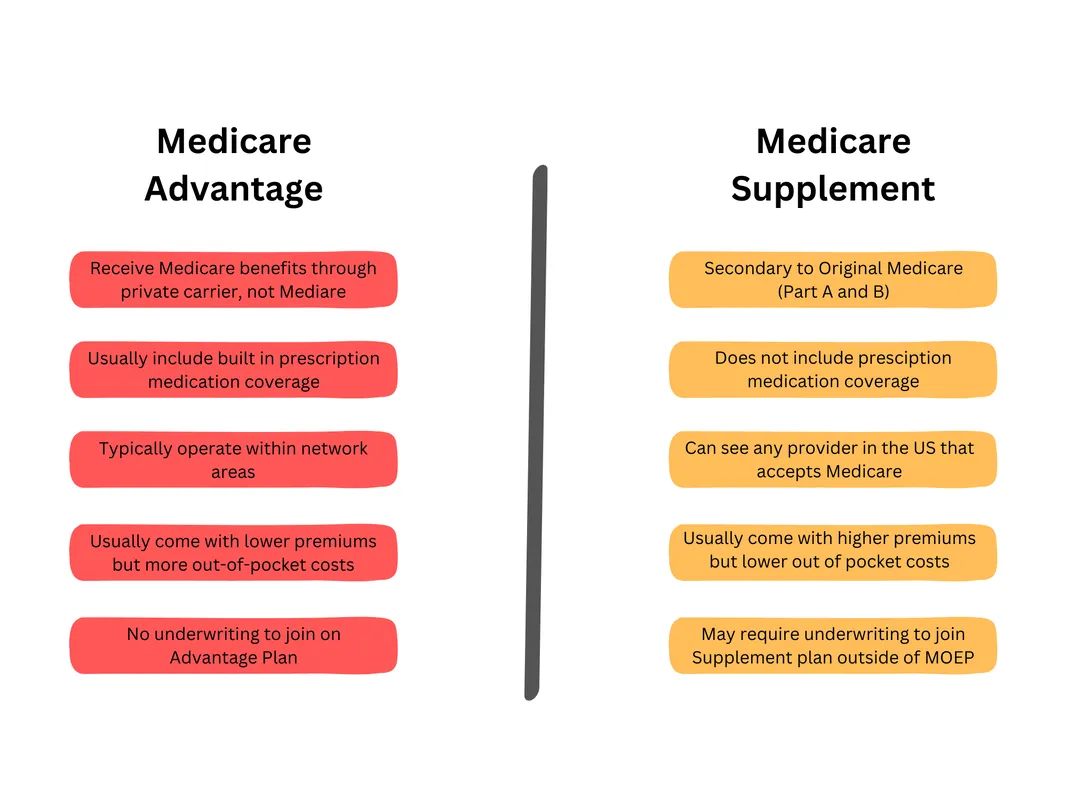

While both Medigap and Medicare Advantage help cover the gaps in Original Medicare, they function in very different ways.

Medicare Supplement (Medigap) plans act as secondary insurance to Medicare Part A and Part B. You remain enrolled in Original Medicare, which pays its share of your healthcare costs first. Any remaining approved expenses are then billed to your Medigap insurer, which covers its portion based on the specific plan you’ve chosen. Popular Medigap plans include Plan F, Plan G, and Plan N, each offering different levels of coverage.

Medicare Advantage plans, on the other hand, are an alternative to Original Medicare. When you enroll in a Medicare Advantage plan, your benefits are provided directly by the private insurance company, not Medicare. These plans typically require you to use a network of providers (except in emergencies) and pay copayments for services as you go.

Let’s take a closer look at these two options to better understand their differences and how they might fit your individual healthcare needs.

Medicare Supplement Plans

Medicare Supplement plans, often referred to as Medigap, work in tandem with Original Medicare, which remains your primary health coverage.

With a Medigap policy, you have the freedom to see any healthcare provider in the U.S. who accepts Medicare, without needing to choose a primary care doctor or get referrals—unlike Medicare Advantage HMO plans.

This gives you nationwide access to care, and when paired with a comprehensive plan like Plan F or Plan G, your out-of-pocket costs—such as doctor copays and coinsurance—can be significantly reduced or even eliminated. Since Original Medicare covers essential services like doctor visits, specialist care, surgeries, and diagnostic exams, Medigap plans are designed to fill in the remaining gaps.

Once you enroll, your Medigap insurance company notifies Medicare of your policy. After Medicare pays its portion of a claim, the remaining balance is automatically forwarded to your Medigap insurer for payment. This creates a seamless experience, with no need for you to file claims or paperwork.

No Referrals and Freedom of Access

Medicare Supplement insurance offers the highest level of flexibility when it comes to choosing healthcare providers. With over 900,000 Medicare-approved doctors and hospitals nationwide, you can see the providers you prefer—no referrals needed, even for specialists.

Because of this broad access and convenience, Medigap plans generally come with higher monthly premiums compared to Medicare Advantage plans. For example, in the Dallas–Fort Worth area, a 65-year-old, non-smoking female can expect to pay around $100 to $130 per month for Plan G in 2024.

Premiums vary based on several factors, including the plan selected, tobacco use, age, gender, and location. At our agency, we compare quotes from over 30 top-rated insurance carriers across 49 states, and we also look for potential household discounts to help lower your monthly cost.

Additionally, many Medigap plans include foreign travel emergency coverage. These benefits typically pay 80% of eligible emergency costs outside the U.S. after a $250 deductible is met—offering valuable protection for frequent travelers.

Separate Prescription Drug Coverage

Medigap plans cover medications administered in a hospital or clinical setting, such as injectables and chemotherapy drugs. However, they do not cover retail prescription medications that you would pick up from a pharmacy.

For this reason, most beneficiaries choose to enroll in a separate Medicare Part D plan to ensure they have prescription drug coverage. Part D plans are available nationwide, with premiums starting as low as $10 per month.

It’s important to note that if you don’t enroll in a Part D plan when first eligible—and don’t have other creditable drug coverage—you may face a late enrollment penalty if you decide to sign up later.

Enrollments for Medigap

When you enroll in a Medigap plan during your one-time Open Enrollment Period—which begins within six months of your Medicare Part B effective date—you’re guaranteed approval without having to answer any health questions. Most beneficiaries choose to enroll during this window to take advantage of this guaranteed issue right.

During this time, there are also no waiting periods or pre-existing condition exclusions, ensuring immediate access to full benefits.

However, if you miss this enrollment window and apply later, you’ll typically be required to complete medical underwriting, which includes answering health-related questions. Underwriting guidelines vary by insurance company and state, and the insurer’s underwriter has the authority to approve or deny your application based on your health history.

Medicare Advantage

Roughly 44% of Medicare beneficiaries choose Medicare Advantage plans, which are offered by private insurance companies. These plans often come with lower monthly premiums than Medigap plans, and in some areas, you may even find plans with a $0 premium.

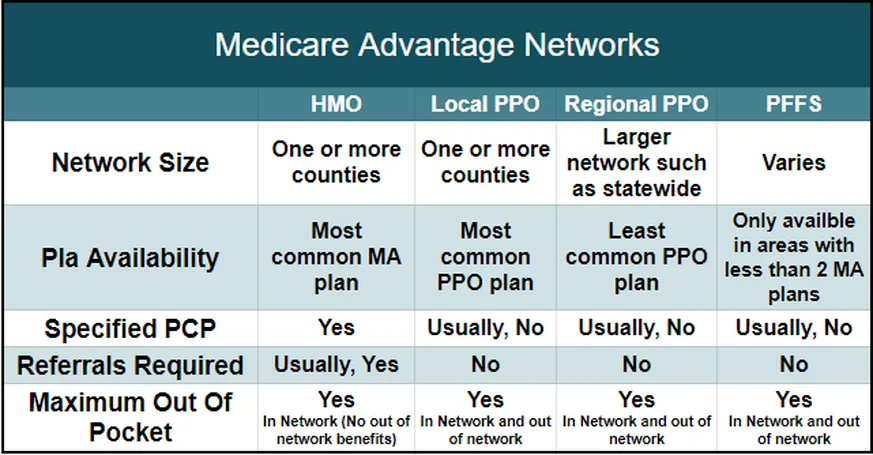

Medicare Advantage plans are available in several formats, including HMOs, PPOs, PFFS (Private Fee-for-Service), and SNPs (Special Needs Plans), each with its own structure and benefits.

A $0 premium plan means you won’t pay anything additional for the plan itself, but you’re still responsible for paying your monthly Medicare Part B premium. To enroll in a Medicare Advantage plan, you must be enrolled in both Medicare Part A and Part B. Most Advantage plans also include prescription drug coverage, so there’s usually no need for a separate Part D plan.

These plans can offer low or no premiums because you agree to use the plan’s network of providers. While this may limit your choice of doctors compared to a Medigap plan, it gives the insurance company more control over costs by contracting with specific providers and facilities at negotiated rates.

Check Your Doctors

Before enrolling in a Medicare Advantage plan, it’s essential to check whether your preferred doctors and hospital are in-network, especially if you’re considering an HMO (Health Maintenance Organization) plan. HMOs typically have smaller provider networks, with some including as few as 250 doctors, making it important to research thoroughly.

Be sure to review the list of local physicians to ensure they accept the plan you’re considering.

While PPO (Preferred Provider Organization) plans generally offer a broader selection of providers, keep in mind that your out-of-pocket costs may be higher, particularly when receiving care outside the network.

When choosing a Medicare Advantage plan, look for one with a robust provider network in your service area. According to the Kaiser Family Foundation, the average Medicare beneficiary has access to over 30 Advantage plans in their ZIP code.

With Medicare Advantage, your healthcare costs are covered by the private insurance company, not Medicare itself. You’ll typically pay copayments for services received from in-network providers. While these copays are often reasonable, it’s important to review them carefully before enrolling. Some plans may also require prior authorization for certain services, so understanding the full scope of your benefits is essential.

Copays can vary from one plan to another—for example, a specialist visit might cost $40 on one plan and $50 on another. If you expect to use medical services frequently, it’s important to consider how these costs may add up over time.

Many Advantage plans also offer extra benefits not included in Original Medicare, such as routine dental, vision, and hearing care, transportation services, gym memberships, telehealth, over-the-counter allowances, and even hearing aid coverage.

When applying for a Medicare Advantage plan, no health questions are asked. Enrollment, disenrollment, or plan changes can typically be made during designated enrollment periods throughout the year.

Review the Medication Formulary

Many Medicare Advantage plans include built-in Part D prescription drug coverage, eliminating the need to purchase a separate drug plan. While this can be convenient, it’s important to proceed with caution. I’ve seen cases where individuals enrolled in a plan without verifying whether their specific medications were covered, only to find out later that their essential—and often costly—prescriptions were not included.

Medicare Advantage plans have set enrollment periods, such as the Medicare Advantage Open Enrollment Period, and once you’re enrolled, you’re generally locked into the plan until December 31. Changes outside these windows are only allowed under special circumstances, which is why it’s critical to choose your plan carefully.

Be sure to research thoroughly, or contact our team for guidance in selecting the right plan. And remember, enrolling in a Medicare Advantage plan does not replace your Medicare Part B premium—you’ll still be responsible for paying that monthly cost.

Understand Your Maximum Out-of-Pocket Costs

All Medicare Advantage plans include an Out-of-Pocket (OOP) Maximum, which protects you by capping your annual healthcare expenses. For 2024, Medicare has set the maximum limit at $8,850, offering a safeguard against high medical costs.

While this cap may seem high—especially for those on a fixed income—it’s designed to prevent overwhelming financial burdens in the event of serious or ongoing health issues. Many Medicare Advantage plans have lower OOP maximums than the federal limit, providing additional protection.

To understand a plan’s specific OOP maximum and what expenses count toward it, review the plan’s Summary of Benefits. It’s important to assess whether you have the financial cushion to manage potential out-of-pocket costs in a high-usage year.

If you’re confident you could handle these costs, Medicare Advantage may be a good fit. However, if that level of risk gives you pause, a Medigap plan may offer a more predictable, low-risk solution for managing your healthcare expenses.

Switching Between Medicare Advantage and Medicare Supplement Plans

Many people ask whether they can start with a Medicare Advantage plan and switch to Medigap coverage later if their health changes or they need more comprehensive benefits. While this strategy—beginning with a lower-cost option and upgrading later—may seem appealing, it’s important to understand that it doesn’t always work out as planned.

If you leave a Medigap plan for Medicare Advantage, returning to Medigap later can be challenging. By that time, you may be outside your one-time Medigap Open Enrollment Period, which means insurance companies are allowed to ask health questions and use medical underwriting. Based on your health history or medications, they can deny coverage or charge higher premiums.

Before switching to Medicare Advantage, be sure to weigh this carefully and understand the long-term implications. Also, there are certain eligibility guidelines and special circumstances to consider when making any Medicare-related decisions. It’s always wise to seek expert guidance before making a change.

Trial Right Exception

There is an important exception to this rule: a trial period applies to individuals trying Medicare Advantage for the first time.

If you disenroll within the first 12 months of joining a Medicare Advantage plan and return to Original Medicare, you are allowed to reapply for a Medigap plan without medical underwriting. However, once that 12-month window closes, you’ll be subject to underwriting, and acceptance is no longer guaranteed.

Under 65 Exception

Another exception applies to individuals under age 65 who qualify for Medicare early due to a disability. While anyone eligible for Medicare can enroll in a Medicare Advantage plan, Medigap availability varies by state. Federal law does not require Medigap insurers to offer coverage to beneficiaries under 65, so not all states make every plan available to this group.

However, some states—such as Colorado, California, Maine, Minnesota, Wisconsin, Oregon, and Missouri—do require insurers to offer all Medigap plans to individuals who qualify for Medicare due to disability.

When these individuals turn 65 and become eligible for Medicare based on age, they receive a second Medigap Open Enrollment Period. During this time, they can switch from Medicare Advantage to a Medigap plan without undergoing medical underwriting.

My Best Tips and Tricks

Over the years, we’ve helped countless individuals navigate their Medicare options, and my top piece of advice is this: plan for the unexpected. Serious health conditions—like cancer—can lead to high out-of-pocket costs with Medicare Advantage plans. For example, you may be responsible for 20% of the cost of chemotherapy or radiation until you reach the plan’s annual out-of-pocket maximum, which can be as high as $8,850.

Rather than paying for a higher-premium Medigap plan upfront, some individuals choose to set aside those funds in a monthly savings account, creating a financial buffer in case a major health issue arises.

That said, Medicare Supplement (Medigap) plans offer more predictable and limited out-of-pocket costs. With Plan G, for instance, your annual responsibility for Medicare-approved services is capped at just the Part B deductible—providing peace of mind and budget stability.

For low-income individuals who qualify for Medicaid, enrolling in a Medigap or Medicare Advantage plan may also be an option—unless they are classified as a Qualifying Medicare Beneficiary (QMB). In such cases, Medicaid might only help with the Part B premium, and you may still be responsible for other cost-sharing.

Every situation is unique. Connect with a Side By Side Insurance Solutions agent for free, personalized guidance to help you make the best decision for your healthcare and financial future.

Need Help Choosing Between Medicare Advantage and Medigap?

Still deciding between Medigap and Medicare Advantage? Choosing the right plan starts with a clear understanding of your healthcare needs and budget as you approach Medicare eligibility. A licensed broker who specializes in both options can help you compare and evaluate what works best for you.

Important factors to consider include:

• Monthly premiums

• Plan deductibles (if applicable)

• Expected costs for healthcare services

• How often you visit doctors or specialists

• Geographic areas where you’ll need care

• Prescription drug copays

• Overall potential out-of-pocket spending

As the saying goes, “You get what you pay for.” While evaluating provider networks and drug formularies can be time-consuming, our licensed agents at Senior Solutions are here to make the process easier.

With experience helping tens of thousands of individuals, we can research Medigap vs. Medicare Advantage plans in your area and help you weigh the pros and cons of each. We’ll show you which plans your doctors accept and which medications are covered, so you can confidently choose the plan that best fits your lifestyle.

Plus, our support doesn’t stop at enrollment. As a client, you’ll have ongoing access to our Client Service Team, ready to assist if your plan ever denies a claim or if questions arise about your coverage.

Key Takeaways

Medicare Supplement and Medicare Advantage plans differ significantly in how they work. Supplement (Medigap) plans act as secondary coverage, filling in the gaps left by Original Medicare, while Advantage plans serve as a replacement for Original Medicare, offering benefits directly through a private insurance carrier.

Both types of plans are offered by private insurers, not managed by the federal government, and come with a variety of coverage options.

If you wish to switch between Medigap and Medicare Advantage, you must do so during specific enrollment periods or under certain qualifying circumstances throughout the year.

Side By Side Insurance Solutions - Get FREE Assistance

If Medicare feels confusing, you don’t have to figure it out alone. Our friendly, knowledgeable agents are here to guide you every step of the way—making the process simple and stress-free.

We start with the basics, helping you understand your Original Medicare coverage. This foundation is key to finding the supplemental plan that fits your needs, especially if you’re new to Medicare.

Once your policy is in place, you’ll have peace of mind knowing we’re just a phone call away whenever you need help or have questions.

Best of all—our services are completely free. Experience the difference of having Side By Side Insurance Solutions on your side. Call (863) 450-1777 or click the button below to get started: