Comparing Medicare Supplement Plans

Key Points

There are ten standardized Medicare Supplement (Medigap) plans, each offering different levels of coverage to complement your Medicare benefits.

As long as your doctor accepts Medicare, they must also accept your Medigap plan—with the exception of Medicare SELECT plans, which may have network restrictions.

The best plan for you will depend on your healthcare needs and budget, as both coverage and premiums vary from plan to plan.

We'll Find The Right Plan for YOU for FREE

We understand Medicare, so you don't have to

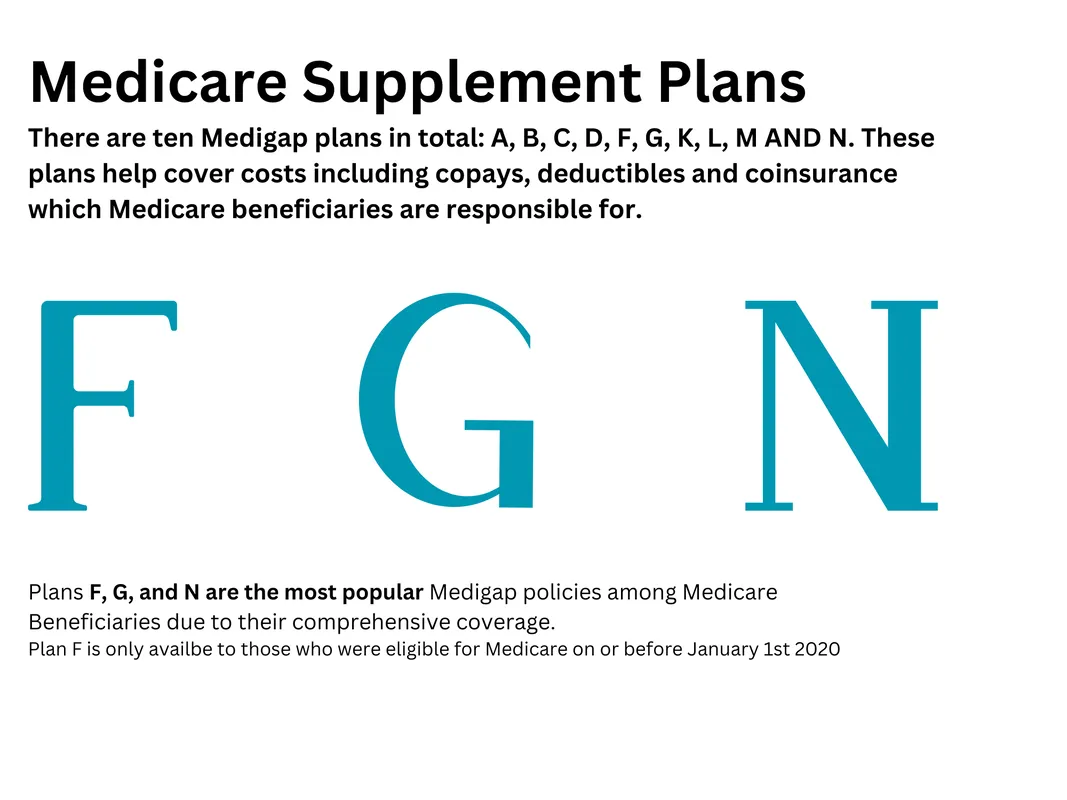

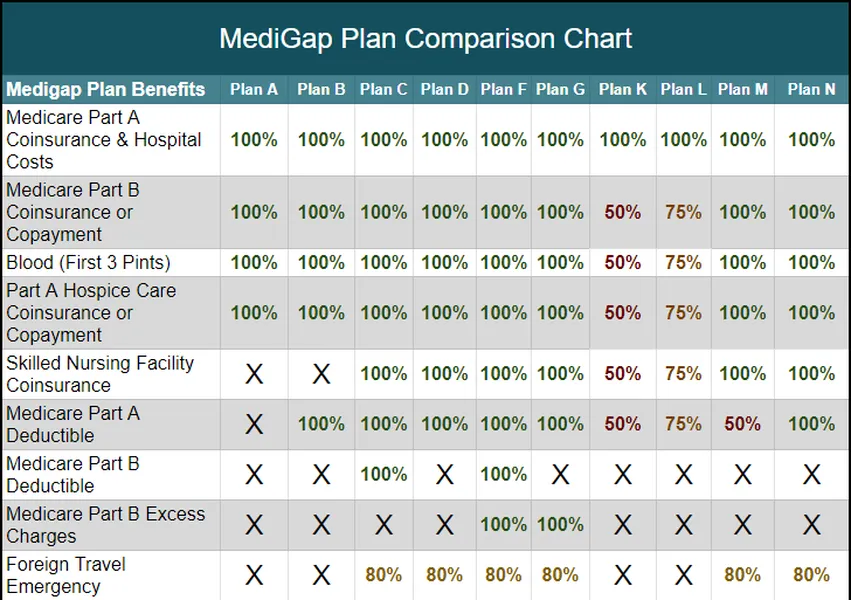

Medicare Supplement plans, also known as Medigap plans, are labeled A through N, with each plan covering different gaps in Original Medicare. Use the comparison chart below to easily evaluate and compare the benefits of each plan.

This chart is updated annually by the Centers for Medicare & Medicaid Services (CMS), although most plan benefits remain consistent from year to year.

Some Medigap plans come with higher premiums but offer broader coverage, while others have lower premiums and may require you to pay more out-of-pocket for certain services. By reviewing the chart, you can identify the plan that best fits your healthcare needs and budget.

The Medicare Supplement comparison chart below is taken directly from Medicare’s official Guide to Health Insurance for People with Medicare.

What does Medigap Insurance entail?

Medigap plans are insurance policies designed to cover expenses that remain after Medicare coverage. You have the option to select a Medigap plan that assists in covering deductibles, copays, and coinsurance. (It's worth noting that these plans are also referred to as Medicare Supplements, essentially denoting the same thing with two different terms.) As you explore Medicare Supplement plans in 2025, you'll discover that well-known carriers are providing these plans.

What Medicare Plan is Best?

Plan F and Plan G are among the most popular Medicare Supplement (Medigap) plans. As shown in the Medigap comparison chart, Plan F offers the most comprehensive coverage, filling all gaps in Original Medicare. Plan G is nearly identical, with one key difference: it does not cover the Medicare Part B deductible.

When comparing Plan F and Plan G, it often comes down to cost. If the premium savings with Plan G exceed the annual Part B deductible, then Plan G is the more cost-effective choice.

Plan G has become increasingly popular, especially since Plan F is no longer available to individuals who became Medicare-eligible on or after January 1, 2020. The same rule applies to Plan C, which also covers the Part B deductible.

Another plan gaining attention is Plan N, which offers lower premiums in exchange for some cost-sharing. However, it does not cover excess charges, so it’s important to understand what that means before enrolling.

Comparing Medigap Plans – Benefits Guide

Comparing Medicare Supplement plans is easier than you might think. Each year, Medicare publishes a guide that includes a side-by-side comparison chart of all standardized Medigap plans. This chart outlines the specific benefits covered by each plan, helping you evaluate which option best fits your needs.

Here are a few important notes to keep in mind:

• In some states, certain insurers offer Medigap Plan F as a high-deductible option. With this plan, you must pay Medicare-covered costs (including coinsurance, copayments, and deductibles) up to $2,800 in 2024 before the plan begins to pay.

• Plans K and L offer limited coverage until you reach your annual out-of-pocket limit, plus the Part B deductible ($240 in 2024). After that, the plan covers 100% of eligible services for the rest of the calendar year.

• Plan N covers 100% of Part B coinsurance, with copays up to $20 for certain office visits and up to $50 for ER visits that don’t result in hospital admission.

• *Plan G is also available as a high-deductible plan, requiring you to meet a $2,800 deductible in 2024 before coverage begins.

You can find this comparison chart and more helpful information in Medicare’s official Choosing a Medigap Policy guide, available here.

Comparison Chart for Medicare Supplement Plans: 10 Options

The below Medicare Supplement Plans comparison chart provides a side-by-side comparison of all plans. This enables you to identify the plans with the most benefits and those that offer less coverage. As previously mentioned, Plan F and Plan G offer the highest percentage of benefits, resulting in minimal out-of-pocket expenses for you.

Medigap Plan A

Medigap Plan A is the most basic option among all Medicare Supplement plans, but it still includes a key benefit—coverage for the 20% of outpatient services that Original Medicare doesn’t pay. This feature is considered essential across all Medigap plans.

While all Medicare-approved insurance carriers are required to offer Plan A, some states do not mandate that it be made available to individuals under age 65 who qualify for Medicare due to disability.

Medigap Plan B

Medigap Plan B includes all the benefits of Plan A, with the added coverage of the Medicare Part A hospital deductible. It functions as supplemental insurance, stepping in to cover costs after Medicare pays its share.

It’s important not to confuse Medigap Plan B with Medicare Part B—a component of Original Medicare that covers outpatient medical services.

Medigap Plan C

Medigap Plan C is one of the most comprehensive Medicare Supplement plans, covering everything except Medicare excess charges. This includes both Medicare deductibles and the 20% coinsurance typically owed for outpatient services.

Plans C and F have long been popular choices among Medicare beneficiaries due to their broad coverage and minimal out-of-pocket costs.

Medigap Plan D

Medigap Plan D covers several out-of-pocket costs, but it does not include the Medicare Part B deductible or excess charges. While it’s one of the less commonly selected Medigap plans, it’s important not to confuse it with Part D, which refers to prescription drug coverage—a completely separate benefit.

Medigap Plan F

Medigap Plan F has long been the most popular Medicare Supplement plan, thanks to its comprehensive coverage. It covers all out-of-pocket costs for Medicare-approved services, meaning no copays, deductibles, or coinsurance—giving you complete peace of mind when visiting the doctor or staying in the hospital.

For those looking to lower their monthly premium, a high-deductible version of Plan F is also available. Once the annual deductible is met, it provides the same full coverage as standard Plan F.

Medigap Plan G

Medigap Plan G has become increasingly popular in recent years, offering comprehensive coverage that closely mirrors Plan F, with the only difference being that it does not cover the Medicare Part B deductible.

Plan G often comes with more competitive premiums, making it a cost-effective alternative to Plan F. In many states, comparisons show that Plan G may offer better overall value on an annual basis, especially when factoring in the lower premiums and minimal out-of-pocket costs.

Medigap Plan K, L, and M

Some Medicare Supplement plans offer limited coverage in exchange for lower premiums. For example, Plan K covers 50% of most benefits, while Plan L covers 75%. These plans are less commonly selected by Medicare beneficiaries and are not offered by all carriers, but competitive rates can sometimes be found in certain regions.

Medigap Plan N, introduced in 2010, has grown in popularity for its lower monthly premiums. In exchange, beneficiaries are responsible for copayments—such as up to $20 for doctor visits and up to $50 for emergency room visits that don’t result in admission. However, Plan N does not cover Medicare excess charges, which some policyholders may find inconvenient.

Still, Plan N remains a top choice for individuals seeking affordable Medigap coverage, as it strikes a balance between cost savings and comprehensive benefits. When comparing Medicare Supplement plans, be sure to consider how copays and out-of-pocket costs align with your healthcare needs and budget.

Inclusion of Doctors in Medicare Supplement Plans

One of the key advantages of Medigap policies is the freedom to see any doctor nationwide who accepts Medicare. This gives you access to a broad network of healthcare providers across the United States.

With a Medigap plan, your choice of insurance company doesn’t limit your provider options. As long as a doctor or hospital accepts Medicare, they will also accept your Medicare Supplement plan—no referrals or network restrictions required.

This is a significant difference compared to Medicare Advantage plans, which often require you to stay within a specific provider network. By choosing Original Medicare with a Medigap plan, you maintain the flexibility to see nearly any doctor, and with about 93% of primary care physicians in the U.S. accepting Medicare, that’s a major benefit.

Different Types of Medicare Supplement Plans

The cost and availability of Medicare Supplement plans can vary by location, and plans are generally priced using one of three methods: community-rated, issue-age-rated, or attained-age-rated. In some states, attained-age-rated plans may offer the lowest premiums, while in others, issue-age-rated plans could be more cost-effective.

Keep in mind that even issue-age-rated Medigap policies are subject to annual rate increases to reflect rising healthcare costs, even though rates aren’t based on your age after enrollment.

Comparing Medigap Plan Rates for 2025

When comparing Medicare Supplement (Medigap) insurance, it’s important to understand that plans are standardized—meaning the benefits for each plan, such as Plan F, are identical across all insurance companies. While coverage remains the same, premiums can vary by company, making it easier to compare based on price, stability, and service.

At Side By Side Insurance Solutions, we typically review the top 3 to 5 most competitively priced carriers for our clients. We also check for household discount eligibility, analyze each carrier’s rate increase history, and focus on companies with strong financial ratings, typically A or B+ and above, to ensure long-term reliability.

Our team provides a personalized report tailored to your ZIP code, including current rates and a history of premium changes over recent years. This helps you make an informed decision and select a Medigap carrier known for both affordability and long-term stability.

Frequently Asked Questions

How Should I choose a plan?

It's important to compare the benefits and monthly premiums of each plan. Typically, the three most popular plans are Plan F, Plan G, and Plan N. Once you've narrowed down your choice of a Supplement plan, you can proceed to compare the carriers that offer that specific plan. Our team is available to assist you in the process of selecting the right plan for your needs.

How many Medigap plans are there?

There are 10 standardized Medigap plans and 2 high-deductible plans, but availability may vary based on your specific situation and state.

Can I change my Medicare plans?

You can switch your Medigap plan at any time during the year. However, if you’re outside your Medigap Open Enrollment Period, you may be required to answer health questions, and approval could depend on your medical history.

It’s also worth noting that some states have exceptions to these rules, offering additional protections or guaranteed issue rights beyond the standard guidelines.

How much do Medigap plans cost?

The cost of a Medigap plan is influenced by various factors, such as your location, age, gender, and tobacco usage. Consequently, the premium for a Medigap plan in your specific area might differ from that of an individual residing in another state.

What happens if they phase my plan out?

Individuals who are newly enrolled in Medicare after January 1, 2020, are no longer eligible for Plan C and Plan F. However, those who are currently enrolled in a Plan C or Plan F policy are allowed to retain their existing coverage.

Key Takeaways

Among the ten standardized Medigap plans, Plan F, Plan G, and Plan N are the most popular choices among beneficiaries.

It’s important to understand the differences between all available plans, as each one offers unique coverage for Medicare-approved services. Choosing the right plan depends on your healthcare needs and budget.

No matter which plan or insurance carrier you select, you’ll have the freedom to see any doctor or healthcare provider that accepts Original Medicare—nationwide.

Side By Side Insurance Solutions - Get FREE Assistance

If Medicare feels confusing, you don’t have to figure it out alone. Our friendly, knowledgeable agents are here to guide you every step of the way—making the process simple and stress-free.

We start with the basics, helping you understand your Original Medicare coverage. This foundation is key to finding the supplemental plan that fits your needs, especially if you’re new to Medicare.

Once your policy is in place, you’ll have peace of mind knowing we’re just a phone call away whenever you need help or have questions.

Best of all—our services are completely free. Experience the difference of having Side By Side Insurance Solutions on your side. Call (863) 450-1777 or click the button below to get started: