MA Open Enrollment

Key Points

The Medicare Advantage Open Enrollment Period runs from January 1 to March 31 each year.

During this time, individuals already enrolled in a Medicare Advantage plan have a one-time opportunity to make a change. You can switch to a different Medicare Advantage plan or return to Original Medicare with the option to add a Part D drug plan.

However, it’s important to note that this period does not allow standalone Part D plan changes for those not enrolled in a Medicare Advantage plan.

We'll Find The Right Plan for YOU for FREE

We understand Medicare, so you don't have to

Medicare beneficiaries who enroll in Medicare Advantage plans may occasionally find themselves in a plan that doesn’t meet their expectations. While the Summary of Benefits provides a clear outline of how a plan works, it’s easy to overlook key details—such as whether a preferred doctor is in-network or how certain benefits are structured.

To address this, Medicare reintroduced the Medicare Advantage Open Enrollment Period (OEP) in 2019, giving beneficiaries a one-time opportunity to make changes if their current plan isn’t the right fit.

This enrollment period isn’t entirely new—it was once a regular feature of the Medicare calendar until it was eliminated by the Affordable Care Act (ACA). In its place, the ACA created the Medicare Advantage Disenrollment Period, which ran from January 1 to February 14 and only allowed beneficiaries to drop a Medicare Advantage plan and return to Original Medicare—with no option to switch to another Advantage plan.

Now, the OEP is back, running from January 1 to March 31, and offering more flexibility. During this time, beneficiaries enrolled in a Medicare Advantage plan can:

• Switch to a different Medicare Advantage plan, or

• Disenroll and return to Original Medicare, with the option to add a Part D drug plan.

Let’s take a closer look at what changes you can make during the 2024 Medicare Advantage Open Enrollment Period.

What does the Medicare OEP entail?

The OEP enables beneficiaries enrolled in a Medicare Advantage Plan to make a single change. During the Medicare OEP, beneficiaries can:

1. Transition from one Medicare Advantage plan to another Medicare Advantage plan

2. Disenroll from a Medicare Advantage plan and revert to Original Medicare, with or without a Part D drug plan

It's important to note that the Medicare OEP does not permit beneficiaries to switch from one Part D plan to another.

The reason for the return of the Medicare OEP

The reason behind this change is rooted in the widespread confusion many beneficiaries face when it comes to Medicare Advantage plans. There is often a lack of understanding about how these plans work, especially regarding provider networks and cost structures. Without guidance from a knowledgeable Medicare insurance expert, individuals may unintentionally make decisions that don’t align with their healthcare needs.

Common issues include enrolling in a plan without realizing their preferred doctor isn’t in-network, or failing to review the drug formulary to ensure all essential medications are covered. Others may focus solely on a plan’s low premium, overlooking the potential for significant out-of-pocket costs, such as hospital copays, which can result in unexpected bills—sometimes as high as $1,400.

Even beneficiaries who work with an agent may still confuse Medicare Advantage with a Medicare Supplement plan, despite clear explanations. At Boomer Benefits, we understand how easily this can happen—which is why we maintain detailed records of every plan we present, ensuring clarity and continuity in the support we provide.

A Solution in Two Steps

To help prevent confusion, lawmakers and insurance companies have added mandatory disclaimers to all Medicare Advantage plan materials. The Summary of Benefits and the plan application clearly and repeatedly state that the policy is a Medicare Advantage plan. These disclaimers are designed to protect both the beneficiary and the insurance agent, especially in situations where the agent has thoroughly explained the plan—but the client may still overlook key details.

In my experience, this misunderstanding often happens because new Medicare enrollees are overwhelmed by the volume of information they receive. The low premiums offered by many Advantage plans can be especially appealing and may cause individuals to miss or tune out the explanation of how the plan actually works.

The updated enrollment materials are the first line of defense against this issue. The reinstatement of the Medicare Advantage Open Enrollment Period (OEP) serves as a valuable second safeguard, giving beneficiaries who misunderstood their plan another opportunity to opt out and return to Original Medicare if needed.

Choosing Not to Be Locked In

Because Medicare Advantage plans lock you in for a full year, many beneficiaries found themselves stuck in plans they didn’t want or fully understand.

Lawmakers recognized that the elimination of the Medicare Open Enrollment Period (OEP) in 2010 left some individuals with no way to make corrections after enrollment mistakes. To address this, the OEP has been reinstated, giving beneficiaries a second chance to adjust their coverage early in the year.

Ambiguity Regarding Medicare Enrollment Periods

The term “Medicare Open Enrollment Period” often leads to confusion, as it’s used to describe multiple, distinct enrollment windows.

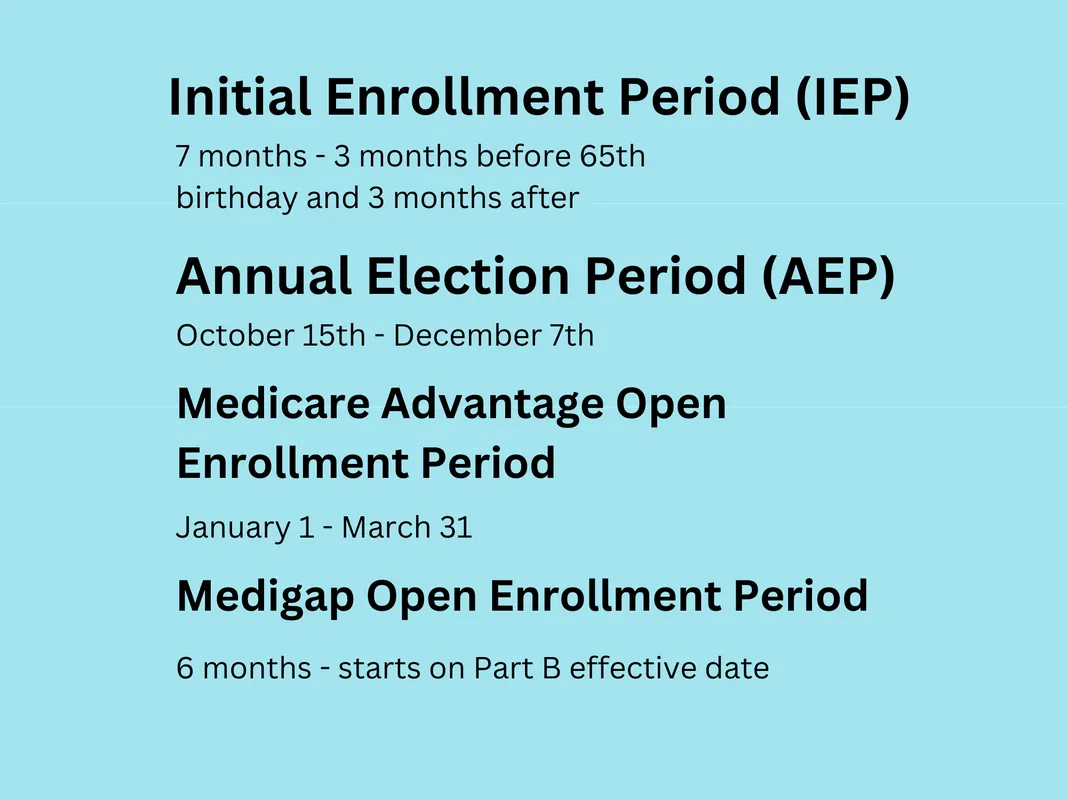

When someone turns 65, they’re eligible for a 7-month Initial Enrollment Period to sign up for Medicare—often mistaken as an open enrollment period.

From October 15 to December 7, the Annual Election Period (AEP) allows beneficiaries to change Medicare Advantage or Part D drug plans, and this too is frequently misidentified as “open enrollment.”

The Medicare Advantage Open Enrollment Period (OEP), running from January 1 to March 31, is specifically for individuals already enrolled in a Medicare Advantage plan who wish to make a one-time change.

Adding to the complexity, new Medicare beneficiaries also have a Medicare Supplement Open Enrollment Period, a one-time window during which they can enroll in a Medigap plan without medical underwriting. This period applies only to Medigap, not Advantage or Part D plans.

With the term “open enrollment” used so broadly—and often incorrectly—many beneficiaries end up confused. There is a growing need for clearer terminology to better distinguish each unique enrollment period.

What does the Annual Election Period entail?

From October 15th to December 7th, the fall Annual Election Period serves as the primary time to make adjustments to your Medicare Advantage plan.

This period is specifically allocated for modifications to Medicare Advantage and Part D drug plans. As your current plan undergoes benefit changes for the following year, receiving your Annual Notice of Change letter in September allows you to assess the upcoming changes. If dissatisfied, the Annual Election Period offers the opportunity to make a switch.

Changes made during this period become effective on January 1st.

What does the Special Election Period entail?

There is a Special Election Period specifically for individuals trying a Medicare Advantage plan for the first time. If you enroll in a Medicare Advantage plan and later regret leaving Original Medicare, you have a 12-month window to switch back.

This trial period can only be used once in your lifetime. If you enroll in another Medicare Advantage plan later on, you’ll be subject to the standard lock-in rules like all other beneficiaries.

If you joined a Medicare Advantage plan at age 65—or if it was your first time ever enrolling in one—you’re also granted a guaranteed issue right to enroll in a Medicare Supplement (Medigap) plan without needing to answer health questions.

Additional Special Enrollment Periods apply in other situations as well. For example, if you move to a new state, you’ll receive a Special Enrollment Period to choose a plan available in your new service area.

What does the Medicare Open Enrollment Period involve?

From January 1 to March 31, the Medicare Advantage Open Enrollment Period (OEP) provides a one-time opportunity to make changes—distinct from the Annual Election Period (AEP).

During this window, you can:

• Switch from one Medicare Advantage plan to another, or

• Drop your Medicare Advantage plan and return to Original Medicare, with the option to add a Part D prescription drug plan.

However, it’s important to understand that this period does not guarantee automatic access to a Medicare Supplement (Medigap) plan.

If you wish to enroll in a Medigap plan, you’ll likely need to go through medical underwriting, which means answering health questions. The insurance company will evaluate your health risk, and coverage may be denied based on your medical history—leaving you with only Original Medicare.

The only exception is if you’re within your first 12 months of trying a Medicare Advantage plan and qualify for the one-time Special Election Period described earlier. In that case, you may return to Original Medicare and enroll in a Medigap plan without underwriting.

This Open Enrollment Period occurs annually, giving beneficiaries a second chance to adjust their coverage early in the year. For more information on switching from Medicare Advantage back to Medigap, visit here.

Key Takeaways

During this period, enrollees have the option to switch from one Medicare Advantage plan to another.

They may also choose to leave their Medicare Advantage plan, return to Original Medicare, and decide whether or not to enroll in a Part D prescription drug plan.

This enrollment window is only available to individuals currently enrolled in a Medicare Advantage plan.

Side By Side Insurance Solutions - Get FREE Assistance

If Medicare feels confusing, you don’t have to figure it out alone. Our friendly, knowledgeable agents are here to guide you every step of the way—making the process simple and stress-free.

We start with the basics, helping you understand your Original Medicare coverage. This foundation is key to finding the supplemental plan that fits your needs, especially if you’re new to Medicare.

Once your policy is in place, you’ll have peace of mind knowing we’re just a phone call away whenever you need help or have questions.

Best of all—our services are completely free. Experience the difference of having Side By Side Insurance Solutions on your side. Call (863) 450-1777 or click the button below to get started: