Medigap Open Enrollment

Key Points

The six-month Medigap Open Enrollment Period guarantees you can enroll in any Medigap plan without medical underwriting—meaning you can’t be denied coverage based on your health.

While you can still apply for a Medigap plan outside of this window, you may be subject to medical underwriting, depending on your state and individual circumstances.

This enrollment period begins on the effective date of your Medicare Part B and lasts for six months, making it the ideal time to secure a Medigap plan.

We'll Find The Right Plan for YOU for FREE

We understand Medicare, so you don't have to

Your Medicare Supplement (Medigap) Open Enrollment Period is a one-time opportunity to enroll in any Medigap plan without answering medical questions. During this window, insurance companies cannot deny your application or charge you higher premiums based on your health.

However, this period only lasts for six months, starting from your Medicare Part B effective date. If you miss it—and don’t have other creditable coverage—you could face higher premiums, limited plan options, or even denial of coverage in the future.

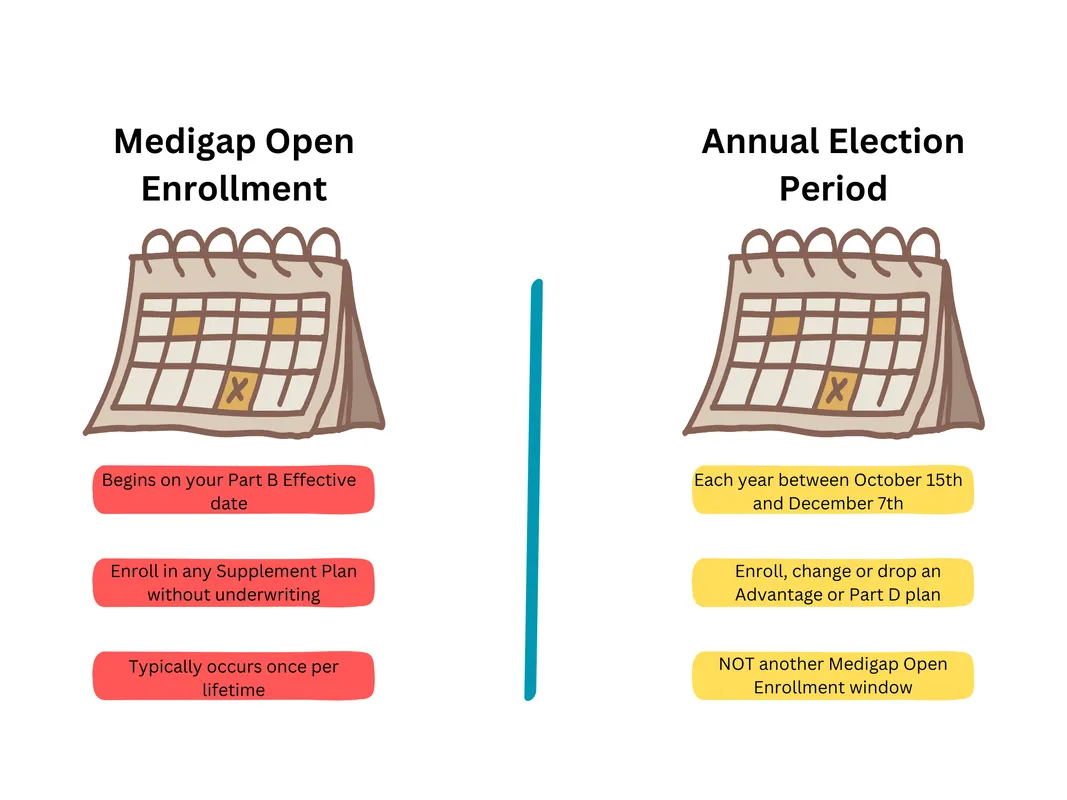

It’s also important to understand that your Medigap Open Enrollment Period is not the same as the fall Medicare Open Enrollment Period, which often causes confusion. Unlike the annual fall period, Medigap OEP dates are unique to each individual. More details on this distinction are provided below.

Information Regarding the Open Enrollment Period for Medicare Supplement Plans

The Medigap Open Enrollment Period is a one-time opportunity for most individuals and does not repeat annually. It lasts for six months, beginning with your Medicare Part B effective date. Once this period ends, you will likely be required to answer health questions if you wish to change or apply for a new Medigap plan in most states.

Individuals under 65 who are on Medicare due to disability will typically receive a second Medigap Open Enrollment Period when they turn 65.

Because Medigap policies are optional supplemental coverage, federal law does not require insurers to accept all applicants outside of certain guaranteed-issue situations. Once your one-time Open Enrollment Period ends, insurance companies may deny your application or charge higher premiums based on your health.

For this reason, it’s strongly recommended to enroll during your personal Medigap Open Enrollment Period, as it offers the broadest access to coverage without medical underwriting.

What is the duration of my Medicare Supplement Open Enrollment Period?

The Medicare Supplement Open Enrollment Period begins on the first day your Medicare Part B coverage becomes effective and lasts for six months. For many, this occurs at age 65, but others may delay enrollment until retirement.

If you qualify for Medicare early due to a disability, you’ll also receive a six-month Medigap Open Enrollment window, with a second opportunity to enroll in more comprehensive plans when you turn 65.

It’s important to note that plans covering the Part B deductible, such as Plan F and Plan C, are only available to those who became Medicare-eligible before January 1, 2020.

When to Apply for a Medicare Supplement Pre 65?

It’s also worth noting that if you’ve applied for Medicare early and already received your Medicare claim number, you can submit your Medigap application ahead of time, even before your Part B effective date.

The insurance company will still treat it as part of your Medigap Open Enrollment Period and process your application without requiring any health questions. Many of our clients secure their Medigap coverage months before turning 65, avoiding the need to wait until their birthday month.

As soon as you receive your Medicare ID card, you can contact us to enroll in your Medigap plan. Your coverage can be set to begin on the same day your Medicare Part B becomes effective.

When else can I Buy Medigap?

You can apply for a Medigap (Medicare Supplement) plan at any time during the year. However, in most states, you’ll need to answer health questions and go through medical underwriting—unless you’re within your one-time Medigap Open Enrollment Period (OEP) or qualify for a guaranteed issue window. Outside of these periods, your application could be declined due to health conditions.

If you’re currently enrolled in a Medicare Advantage plan and wish to switch to a Medigap plan, this change must be made during a valid enrollment period, such as the Annual Election Period (AEP).

Some states, including California and Oregon, offer an annual Medigap Open Enrollment window, typically lasting 30 days. This allows you to shop around and see if other insurance companies offer the same plan at a lower rate.

To qualify for these special windows, you must already have a Medigap policy and be switching to a plan with equal or lesser benefits.

Why should I Buy During my Open Enrollment?

The timing of your Medigap (Medicare Supplement) enrollment is critical, as it directly affects your coverage options and eligibility. Here’s why it matters:

The Medicare Supplement Open Enrollment Period is a one-time opportunity to enroll in any Medigap plan—A, B, C, D, F, G, K, L, M, or N—without medical underwriting. During this 6-month window, which begins on your Part B effective date, you can choose any plan, and the insurance company must accept your application, regardless of your health status.

Ordinarily, Medigap applications include a full page of health-related questions. However, if you apply during your Open Enrollment Period, you can skip those questions, and the insurer cannot deny your application or charge you more due to medical conditions.

Once this window closes, most applications will require medical underwriting. At that point, insurers can approve or deny coverage based on your health, making it more difficult—and sometimes impossible—for individuals with pre-existing conditions to secure a policy.

This is why the Medicare Supplement Open Enrollment Period is so important. It’s often the best—and sometimes only—chance to get the coverage you need without restriction.

How about the Annual Open Enrollment each Fall?

Every year, numerous Medicare beneficiaries erroneously assume they can submit an application for a Medicare Supplement plan without facing health questions during the fall Open Enrollment period, commonly known as the Annual Election Period. This misconception can be a surprising revelation for individuals who did not conduct proper research in advance.

It's essential to recognize that the Open Enrollment period in the fall exclusively pertains to Part D drug plans and Medicare Advantage plans. In our discussions, we refer to it as the Annual Election Period (AEP) to aid our clients in distinguishing between these two distinct periods.

The Annual Election Period (AEP) occurs annually from October 15th to December 7th. Within this timeframe, individuals have the opportunity to join or switch their Part D drug plan, as well as transition between different Medicare Advantage plans. It's the designated period for enrolling in or disenrolling from a Medicare Advantage plan.

It's crucial to note that the AEP doesn't grant an exemption from answering health questions when applying for a Medicare Supplement. As mentioned earlier, while you can apply for a new Medicare Supplement plan at any time during the year, most states require responding to health questions and undergoing medical underwriting for approval.

What if I've Missed the Medicare Supplement Open Enrollment Period?

Fortunately, there’s an alternative option: Medicare Advantage. One key benefit of Medicare Advantage plans is that they do not require medical underwriting. This means you can enroll in a plan available in your area during the next Annual Election Period (AEP), regardless of your health status.

While you may have preferred a Medicare Supplement—which allows you to see any doctor that accepts Medicare—Medicare Advantage plans often come with provider networks, and using in-network doctors typically results in lower copays.

However, many Medicare Advantage PPO plans offer added flexibility, allowing you to see out-of-network doctors at a higher cost. This still provides comprehensive coverage, helping you avoid the 20% coinsurance you’d otherwise be responsible for under Original Medicare alone, especially for major services like surgery.

Is there a second open enrollment opportunity for Medigap?

In certain situations, individuals may qualify for two Medigap Open Enrollment Periods.

The first scenario applies to those who became eligible for Medicare before age 65 due to a disability. These individuals receive a 6-month Medigap Open Enrollment Period starting with their Part B effective date. Then, when they turn 65 and age into Medicare naturally, they’re granted a second 6-month Open Enrollment Period.

This second opportunity exists because some states do not require Medigap insurers to offer all plans to individuals under 65. Turning 65 gives them the same full enrollment rights as others who first qualify for Medicare at age 65—no health questions required.

The second scenario involves someone who enrolled in Medicare at 65 but later returned to full-time work and obtained creditable employer coverage. If they drop their Medigap plan and Part B due to employer coverage, they’ll receive a new 6-month Open Enrollment Period when they retire again and re-enroll in Part B.

These unique situations ensure individuals have another chance to secure guaranteed Medigap coverage when re-entering Medicare.

Guaranteed Issue vs Medigap Open Enrollment

Many individuals miss their Medigap Open Enrollment window because they continue working past age 65. Some enroll in both Medicare Part A and B while still covered under a group health plan, aiming to reduce medical expenses. However, when they retire years later, they realize their Medigap Open Enrollment Period has already passed.

Fortunately, Medicare provides a Guaranteed Issue (GI) period for these situations. If you’ve maintained creditable employer group coverage, you’re entitled to a 63-day GI window once that coverage ends.

During this GI period, you can enroll in Medigap Plan A, B, C, F, K, or L without answering health questions—if you were eligible for Medicare before January 1, 2020.

If you became eligible on or after January 1, 2020, your GI options include Plans A, B, D, G, K, or L. In either case, the insurer cannot deny coverage or impose waiting periods for pre-existing conditions.

It’s important to note that Medigap Plan N is generally not included in guaranteed issue protections. If you prefer Plan N, you may still apply, but it will likely require medical underwriting.

Key Takeaways

While most people have only one Medigap Open Enrollment Period, certain situations may qualify you for a second opportunity.

It’s important to understand that the Medigap Open Enrollment Period is not the same as the Annual Election Period (AEP) in the fall. The AEP applies to Medicare Advantage and Part D plans, and does not affect Medigap enrollment.

For personalized guidance on the best time to enroll in Medicare, feel free to contact our team at (863) 450-1777. Our assistance is completely free.

Side By Side Insurance Solutions - Get FREE Assistance

If Medicare feels confusing, you don’t have to figure it out alone. Our friendly, knowledgeable agents are here to guide you every step of the way—making the process simple and stress-free.

We start with the basics, helping you understand your Original Medicare coverage. This foundation is key to finding the supplemental plan that fits your needs, especially if you’re new to Medicare.

Once your policy is in place, you’ll have peace of mind knowing we’re just a phone call away whenever you need help or have questions.

Best of all—our services are completely free. Experience the difference of having Side By Side Insurance Solutions on your side. Call (863) 450-1777 or click the button below to get started: